Renowned tech analyst Ming-Chi Kuo of TF International Securities has shared some insights on Tesla’s $16.5 billion AI6 deal with Samsung. As per the analyst, the deal is a valuable opportunity for Tesla to bolster its chip design and manufacturing expertise.

Kuo’s endorsement, which was posted on X, highlighted the deal’s potential to reshape the electric vehicle maker’s supply chain and strengthen its standing in the semiconductor landscape.

Tesla’s Strategic Gain

Kuo, who widely regarded as the “best Apple analyst on the planet” due to his eerily accurate forecasts, noted that the Tesla-Samsung partnership is a game-changer. He emphasized that Tesla’s access to Samsung’s Texas foundry will enhance the EV maker’s chip design capabilities. This was highlighted by CEO Elon Musk on X, when he stated that he would be walking the line “personally to accelerate the pace” of the facility’s progress.

“For Elon Musk and Tesla, this represents a valuable opportunity to gain real-world foundry experience at an exceptionally low cost — something TSMC would never allow,” Kuo wrote in his X post.

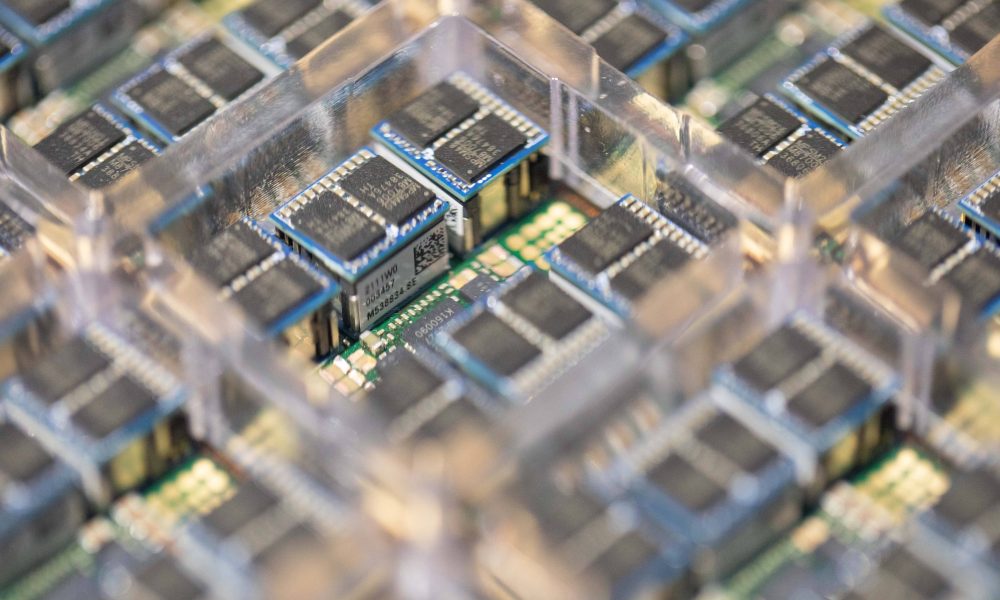

The deal tasks Samsung’s new Taylor, Texas, facility with producing Tesla’s AI6 chips, which are expected to be used for large volume products like the Cybercab and Optimus. Kuo’s analysis highlighted that the move diversifies Tesla’s reliance on Taiwan Semiconductor Manufacturing Co. (TSMC), which has been contracted to produce the EV maker’s AI5 chip.

Challenges and Optimism

Kuo acknowledged risks in Samsung’s 2nm SF2 process, which has a lower yield compared to TSMC’s 2nm N2 node. Yet, he remains optimistic, noting that “Elon Musk’s execution is proven, and SF2’s adoption of the same GAA technology as SF3 should facilitate mass production.”

Even if Samsung were to falter, Kuo noted that Tesla could simply shift its AI6 deal to TSMC, absorbing design know-how in the process. TSMC, after all, would likely accept Tesla’s business considering the scale of the company’s Cybercab and Optimus business.

“If production falls short of expectations, the worst-case scenario for Tesla would be to shift the order back to TSMC and absorb the resulting delays to AI6. However, Tesla’s edge in real-world AI could significantly reduce the risk of AI6 delays. Regardless, Tesla still gains from enhanced design capabilities and deeper chip manufacturing know-how,” Kuo wrote.

For Samsung, Kuo sees the deal as a low-risk, high-reward scenario. The Tesla deal could then reinvigorate the South Korean tech giant’s foundry business, positioning Samsung as a viable TSMC rival.

“If AI6 reaches mass production smoothly, chip design and manufacturing could become a core competitive advantage across Elon Musk’s businesses — enabling greater flexibility and lower costs. While Samsung may not fully catch up with TSMC in advanced nodes, it has at least discovered a new business model that actively involves customers in the manufacturing process,” the analyst wrote.